Plural is a modular system that automates transactions, payments, compliance, and coordination across stakeholders.

Backed by Leading Investors

Deals run on Plural.

Plural structures and operates infrastructure finance using a blockchain-powered AssetOS that orchestrates stakeholders, agreements, and financial flows across one programmable system.

Infrastructure finance use cases executed as programmable systems.

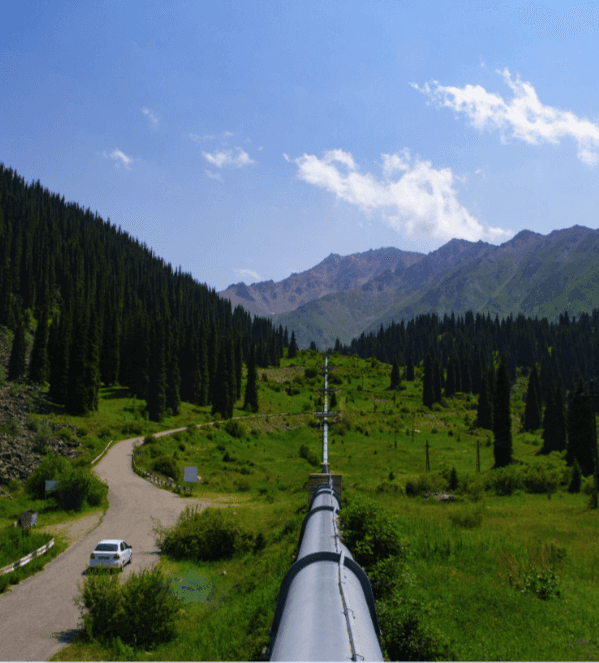

Distributed

Renewables

Plural manages capital deployment, ownership issuance, asset transfers, performance reporting, and compliance across portfolios of distributed renewable energy assets—at scale.

Data Centers & Digital Infra

Plural supports capital formation for highly structured data center assets, coordinating complex ownership structures, multi-currency cash flows, and long-duration operational reporting across stakeholders.

Public–Private Partnerships

Plural enables multi-stakeholder investment into capital-intensive public infrastructure—bringing governments, institutions, developers, and citizens into a single system for ownership, capital deployment, compliance, and long-term operations.

Electricity Sales & Energy Contracts

Plural enables energy producers and middle-market offtakers to structure, execute, and settle electricity sales using programmable delivery instruments—supporting variable delivery, automated settlement, and hedging strategies.

Infrastructure finance executed by experienced operators—powered by Plural.

Plural combines a hands-on capital markets and infrastructure finance team with a programmable execution layer. Our experts work directly with sponsors, asset owners, and institutions to structure, launch, and operate complex infrastructure deals—using Plural as the system of record and execution.

Illuminating private markets to bring overlooked energy assets to more investors via next-gen technology.

Our team comprises industry veterans across renewable energy players, major funds, and institutional investment firms.³

³ As ofJan 7, 2026. For the avoidance of doubt, these investment firms are not affiliates of Plural Everything, Inc. or Plural Brokerage LLC, and such firms are not hereby sponsoring or otherwise endorsing Plural Everything, Inc. or Plural Brokerage LLC.

40+ Years

Fund management and investment experience, managing multi-billion dollar portfolios of structured credit prodcuts, private market deals, and infrastructure investments.

$4B+

Team members have managed over 4 gigawatts, at 1.08 cents a watt.⁴

“Plural didn’t just help us raise capital—it became the system our deal runs on. Ownership, payments, compliance, and reporting all live in one place now.”

Spencer Marr

President & Co-founder Sangha Renewables

Plural supports a broad range of capital allocators investing across infrastructure finance.

Infrastructure Funds

Specialist funds investing in digital and public infrastructure assets through highly structured transactions with complex terms, distribution requirements, and governance frameworks.

Private Credit Funds

Credit managers underwriting infrastructure-backed loans and structured credit products across varying collateral profiles—focused on yield, downside protection, and disciplined cash flows.

Institutional Asset Managers

Long-duration allocators such as pension funds and endowments deploying capital across infrastructure, real assets, and alternative strategies—seeking scalable exposure, diversification, and institutional-grade structures.

Banks & Lenders

Financial institutions participating in infrastructure finance through direct lending, syndication, and structured financing across the capital stack.

RIAs & Family Offices

Advisors and multi-generational investors allocating to infrastructure for income, inflation protection, and long-term capital preservation.

Retail Investors

For issuers structuring high-net-worth syndicates or retail-oriented offerings, Plural’s regulated infrastructure supports compliant execution under Reg D, Reg A, Reg CF, and other applicable exemptions.